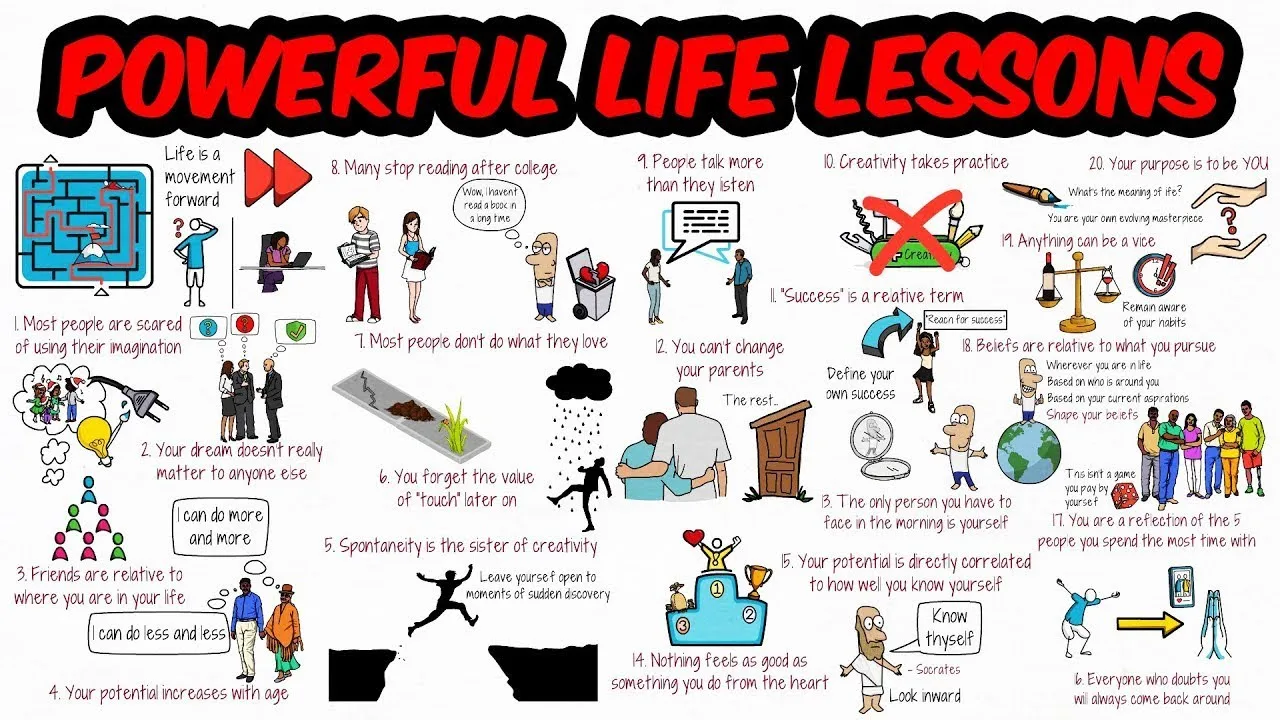

Managing your finances effectively is the foundation of financial stability and success. With the right financial budgeting tips, you can take control of your money, reduce stress, and achieve your financial goals. Whether you’re just starting out or looking to refine your budgeting skills, these practical strategies will help you transform your money management.

Why Financial Budgeting Matters

Budgeting is more than just tracking expenses—it’s about creating a plan for your money that aligns with your goals. By following these financial budgeting tips, you can build a solid financial foundation, avoid debt, and save for the future. Let’s dive into the steps to improve your budgeting skills.

Tip 1: Track Your Income and Expenses

The first of our financial budgeting tips is to track your income and expenses. Use a budgeting app, spreadsheet, or notebook to record every dollar you earn and spend. This will give you a clear picture of where your money is going and help you identify areas to cut back.

Tip 2: Create a Realistic Budget

A budget is only effective if it’s realistic. Start by listing your fixed expenses (rent, utilities, etc.) and variable expenses (entertainment, dining out, etc.). Allocate a portion of your income to savings and investments. This is one of the most important financial budgeting tips for long-term success.

Tip 3: Prioritize Saving

Saving should be a non-negotiable part of your budget. Aim to save at least 20% of your income, whether it’s for an emergency fund, a big purchase, or retirement. Automating your savings can make this process easier and more consistent.

Tip 4: Cut Unnecessary Expenses

One of the most actionable financial budgeting tips is to cut unnecessary expenses. Review your spending habits and identify areas where you can reduce costs, such as subscription services, dining out, or impulse purchases. Redirect these funds toward your financial goals.

Tip 5: Use the 50/30/20 Rule

The 50/30/20 rule is a simple yet effective budgeting framework. Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. This approach ensures a balanced budget and helps you stay on track.

Tip 6: Plan for Irregular Expenses

Unexpected expenses can derail your budget if you’re not prepared. Set aside a small amount each month for irregular costs like car repairs, medical bills, or holiday gifts. This is one of the most practical financial budgeting tips to avoid financial stress.

Tip 7: Review and Adjust Regularly

Your budget isn’t set in stone—it should evolve as your financial situation changes. Review your budget monthly and make adjustments as needed. This ensures your budget remains aligned with your goals and priorities.

Final Thoughts

By implementing these financial budgeting tips, you can take control of your finances, reduce stress, and achieve your financial goals. Budgeting is a powerful tool that empowers you to make informed decisions about your money and build a secure future.

Call-to-Action (CTA)

Ready to transform your money management? Start applying these financial budgeting tips today and explore more resources and guides at OneScholar.org. Your journey to financial freedom begins now—take the first step!

VIDEO CREDIT: